Bring HOPE

Donations, contributions, or gifts given within the taxable year can be fully claimed as tax-deductible because HOPE worldwide Philippines is an accredited donee and charitable institution by the Philippine Council of NGO Certification.

Donate Now

Child Empowerment and Protection

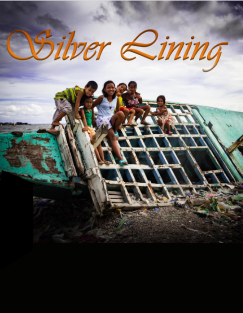

The Philippines is a land of abundant beauty, but underlying its external image is the ugly face of poverty. With a population of more than 100 million people, 44% live in poverty or below US$2 a day. Children constitute nearly 45% of the population and more than 5 million children are engaged in child labor. 1 out of 3 Filipino children is a victim of some type of abuse. Sadly, less than 10% of sexual abuse cases are reported. There are reports of 60,000 children being prostituted each year and Filipino children are the targets of pedophiles on international cybersex activity.

HOPE worldwide Philippines

HOPE worldwide Philippines currently operates educational and feeding programs for poor Filipino children in the communities of Baseco, Payatas, Laguna, Tacloban, Ormoc, and Cebu. These community-based programs provide children with educational support, feeding assistance, access to medical services as well as recovery and treatment from child abuse. The children's families also receive family development and parental effectiveness training. In further support of these efforts, a mobile puppet theater provides entertaining and engaging information to thousands of children each year about child protection issues faced by children living in impoverished communities as well as emergency relief and recovery during disasters. Our request is for annual support of each child from our six (6) Centers of HOPE.

Child Sponsorship Beneficiaries

Abused children from our residential and community Centers of HOPE in need of protection, shelter, food, clothing, education, psychological treatment, and case management.

Children in-crisis-situation from our community centers in need of family development intervention, basic education, protection, food, and emergency assistance.

Undernourished children from our daycare and feeding program in need of assistance on health, nutrition, protection, and early childhood care and development.

Monetary donations can be deposited to:

A.) PESO Donations

| Bank | BDO Unibank, Inc. |

| Bank Branch | A. Mabini, Biñan City, Laguna, Philippines |

| Savings Account | 4-240-12454-1 |

| Account Name | HOPE worldwide Philippines, Inc. |

| Swift Code | BNORPHMM |

| Bank | Rizal Commercial Banking Corp. (RCBC) |

| Bank Branch | RCBC Plaza 6819 Ayala Ave., Makati City Philippines |

| Savings Account | 3-000-72845-3 |

| Account Name | HOPE worldwide Philippines, Inc. |

| Swift Code | RCBCPHMM |

B.) US Dollar Donations

| For Credit to | Rizal Commercial Banking Corp. (RCBC) |

| Swift Code | RCBCPHMM |

| Account Name | HOPE worldwide Philippines, Inc. |

| Bank's Address | Rizal Commercial Banking Corp. (RCBC) |

| Bank Address | RCBC Plaza 6819 Ayala Ave., cor. Sen. Gil Puyat Ave., Makati City, Philippines |

| Further Credit to | HOPE worldwide Philippines, Inc. |

| Dollar Account No. | 8-000-08576-7 |

How our funds used?

To directly help the children and their family through provision of supplies, materials, food, educational support, protection, treatment and case management, emergency and medical assistance, parents’ capacity building and community and professional services through the Centers of HOPE. 70% of the budget directly supports the food, transportation, medical, and school needs of the child. 20% of the budget will support the project monitoring, evaluation, computer laboratory, library, protection, and the family and community support services in the Centers of Hope. 10% of the budget is allocated for the administration and management of the program.

Under-Nourished Children

Provide an under-nourished child with the following services:

Early Childhood Education, Family Intervention and Protection (30%)

Feeding and medical care - a nutritious meal and a snack per day, health monitoring by staff nurse and nutritionist (60%)

Management and staff support (10%)

Children-in-Crisis Situation

Provide a child-in-crisis situation the following services:

Educational support (32%)

Food and Nutrition (50%)

Family Development Training, Protection, Medical, and Emergency Assistance (8%)

Management Support (10%)

Abused Children

P10,000 (US$ 200 - Month/child)

Basic Education (11%)

Food and nutrition (16%)

Clothing, utilities, and recreational activities (11%)

Case management and Legal support (12%)

Treatment and Recovery Interventions (12%)

Shelter, Protection, and staff support (30%)

Management Support (10%)

P5,000 (US$ 100 - Month/child)

Basic Education (14%)

Case management and Legal support (34%)

Treatment and Recovery Interventions (34%)

Management Support (8%)

Donations are Tax Deductible

Can the gift or donation be deducted in full?

Yes, donations, contributions or gifts which are or made within the taxable year can be fully claimed as deduction because HOPE worldwide Philippines is an acredited done and charitable institution.

We will be issuing you a CERTIFICATE OF DONATION (BIR Form No. 2322) which you can use for BIR Purposes. Please check the Revenue Regulations No. 13-98 and other related information at www.pcnc.com.ph for accredited NGOs.

Annual Reports

Major Donors

Thank you for your continued support and partnership!

Let's bring HOPE

Pure and genuine religion in the sight of God the Father means caring for orphans and widows in their distress and refusing to let the world corrupt you. James 1:27 NLT